HSA/FSA payments with Flex

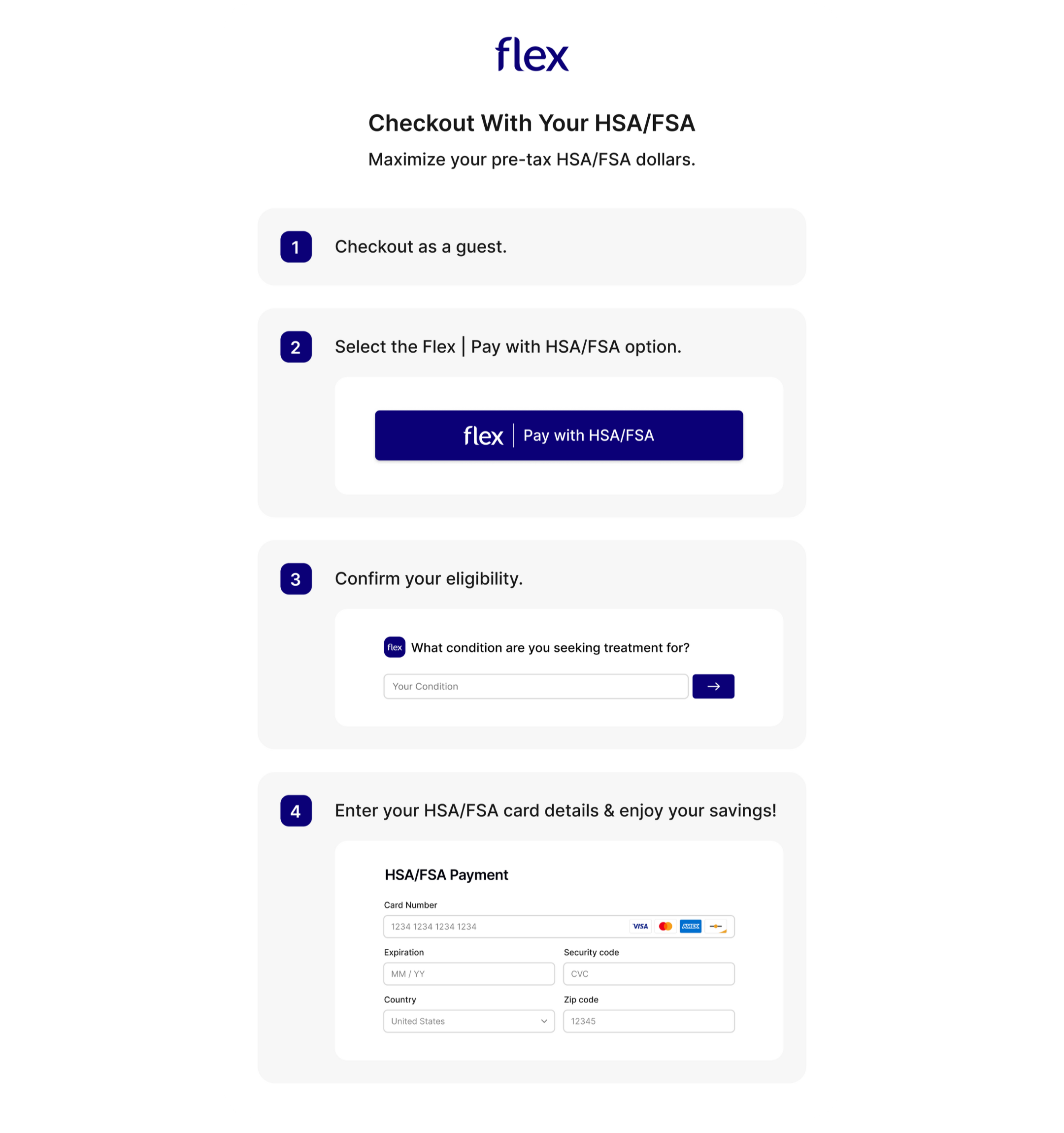

At checkout, choose Flex | Pay with HSA/FSA as your payment option. You’ll be prompted to complete a quick telehealth consult to confirm your eligibility. Once approved, enter your HSA or FSA debit card to finish your purchase.

Don’t have your card handy? No problem — you can also check out using a regular credit or debit card.

Within 2 hours of your purchase, Flex will email you both a Letter of Medical Necessity as well as an itemized receipt. Keep these documents for your records should your HSA/FSA provider or the IRS require additional documentation.

That’s it! For more information, check out our Flex FAQs or reach out to support@stimara.com

FAQs

What is a qualified customer?

A qualified customer is someone who has a medical condition or diagnosis that a healthcare provider confirms can be helped by using Stimara products. To use HSA or FSA funds, the IRS requires a Letter of Medical Necessity—a note from a provider stating the product is needed for medical care.

Stimara has partnered with Flex to make getting this letter fast and easy, all within our checkout process.

What is an HSA or FSA, and what are the benefits?

An HSA (Health Savings Account) and FSA (Flexible Spending Account) are special accounts that let you set aside pre-tax money to pay for eligible health expenses—like medical products, doctor visits, and prescriptions.

Benefits include:

- You don’t pay taxes on the money used.

- Use HSA/FSA funds instead of your regular income.

- Many wellness and medical products qualify.

I am not seeing HSA/FSA or Flex at checkout, why not?

The key here is to make sure you are logged out of ShopPay. One of the easiest ways to do this is to go through checkout in an incognito window.

I am having issues checking out with Flex for HSA/FSA payment, who should I contact?

For any issues releated to HSA/FSA payments, please reach out to support@withflex.com

Still have questions?

Check out our HSA/FSA specific FAQs in our help center for more information